Growing a family business

VADO has a special bond with family businesses. From our own history, we have a natural bond with family-owned companies. Therefore we understand very well entrepreneurs who are looking for a reliable partner to take over their (family) business. They think in terms of generations rather than quarters, and as an employer they often play an important role within their own region.

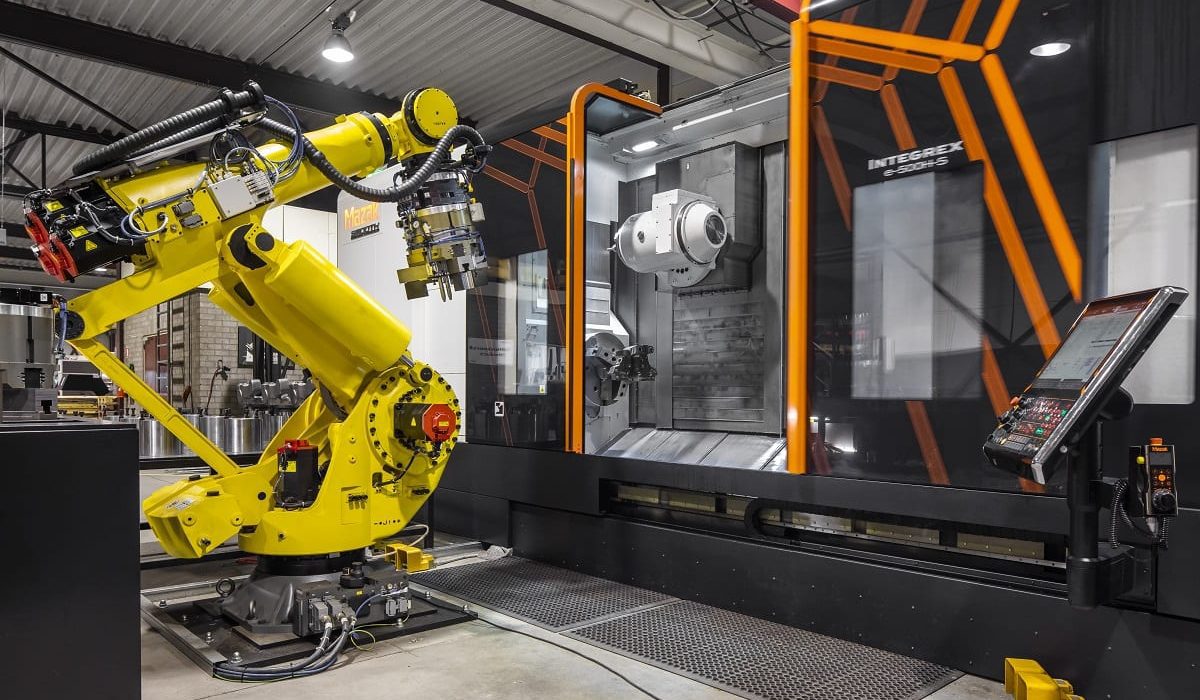

A good example is Lacom Machinefabriek B.V. Managing Director Driek Lammers started Lacom in 1989 and sold the family business to VADO in 2006. An important factor in his choice of VADO was their recognition of the special character of the family business. Also, after the sale he remained with Lacom as managing director and still experiences that same family feeling. He has continued to be an entrepreneur, because over the years he has developed Lacom, together with VADO, into an ultra-modern all-round specialist in metal processing. With the start of Lacom Cranes & Supplies B.V. at the end of 2019, Lacom has now also developed into an innovative player in the mobile truck-mounted cranes market as well.

Acquisitions that create value

“If I realise an acquisition today where I can’t add value, I think I’ll not be able to create synergy advantages,” says Driek Lammers. “For us, growth should not be the goal in itself. You should not want to grow for the sake of growing. You must grow by making the right choices and by making the company healthier. Our goal is to create value within the chain that will contribute to all of us. The moment customers see that a company is active in this way, and is not afraid to invest, it will generate confidence.

VADO likes to invest in innovative, technical, (family) businesses.

We do this with respect, and as a first step, take sufficient time to get to know each other and to see how well we fit together. Our way of working? Read more about it in our article ‘Acquisition of a family business requires a special approach’. Curious to know what our companies think about this themselves? Listen to the stories of e.g. Anvil Industries and Pekago Covering Technology.

If you like to know more about the possibilities that we offer with regard to company takeovers and investments in family businesses, please feel free to contact us for an introductory meeting.